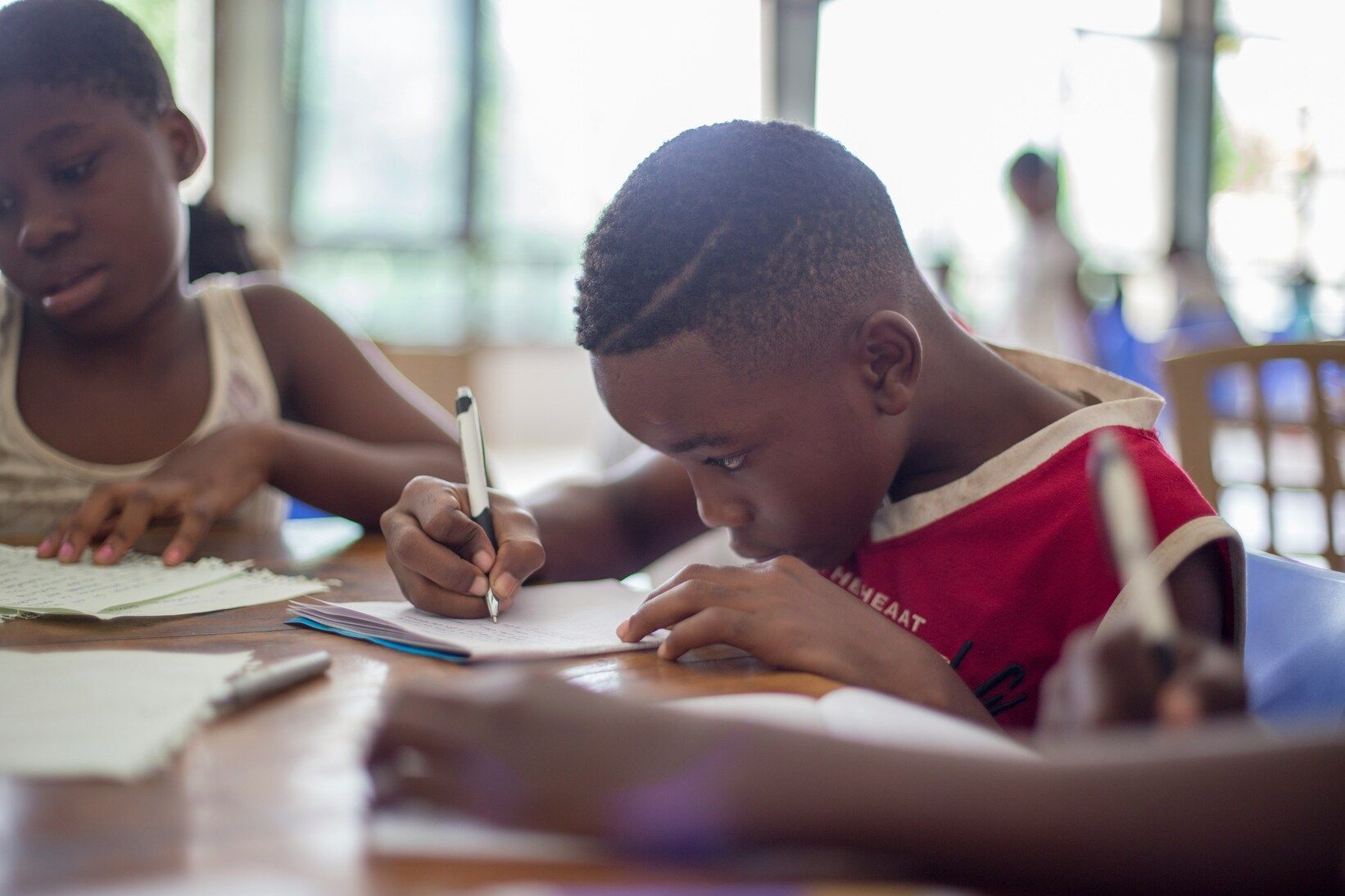

The Importance of Financial Literacy for Kids

Financial decisions are a part of our everyday lives and for this reason, the importance of financial literacy for kids cannot be overstated. Teaching children about money, and how to manage it, from an early age equips them with essential life skills. It helps them understand value, make informed choices and develop independence. In Kenya’s fast-changing economy, where digital payments and entrepreneurship are on the rise, early financial education is not just beneficial, it’s essential for the future.

What is Financial Literacy for Kids?

Financial literacy for kids means helping children understand how money works, from earning and saving to spending and investing. It’s about introducing age-appropriate lessons that grow with the child.

For younger learners, this could mean understanding the difference between needs and wants or saving coins in a piggy bank. For older students, it involves budgeting, tracking spending and learning about simple investments. Financial literacy goes beyond math; it nurtures responsibility, discipline and foresight.

Like developing critical thinking skills (learn more about how Makini nurtures these skills), financial education trains young minds to think ahead, weigh up the consequences and make smart choices, all skills that will serve them far beyond the classroom.

Why Early Financial Education Matters in Kenya

Kenya’s economy offers a unique environment for early financial education. From a young age, children see their parents or grandparents doing mobile money transactions, giving them firsthand exposure to money management in a digital money society. However, without guidance, this exposure can lead to misunderstandings about saving and spending.

Teaching kids money management from an early age helps them navigate real-world challenges such as high youth unemployment, economic uncertainty and the temptation of instant gratification. When children learn about earning, saving and delayed rewards, they grow into adults who can make sound financial decisions and even identify entrepreneurial opportunities.

Moreover, as Kenya continues to embrace digital tools in both learning and finance, understanding financial systems becomes as vital as digital literacy (see how Makini fosters digital awareness).

Benefits of Teaching Kids About Money

1. Builds Healthy Financial Habits

The benefits of teaching kids about money begin with habit formation. Children who learn to set aside a portion of their allowance develop a lifelong saving mindset. These habits, which are formed early, translate into responsible adult behaviour around spending and investment.

2. Encourages Responsibility and Independence

Financial literacy empowers children to make their own choices. Whether deciding between toys or saving for something bigger, teaching children about money fosters accountability. It helps them understand that financial independence comes from planning, patience and discipline.

3. Prepares for Real-World Challenges

Understanding money early prepares students for adult realities like budgeting, paying bills and planning for emergencies. In Kenya, where self-employment and entrepreneurship are common, youth money skills can set the foundation for future business success. By learning how to handle money responsibly, children gain the confidence to manage their own ventures or contribute meaningfully towards family businesses.

When and How to Start Teaching Kids About Money

It’s never too soon to introduce early financial education. The approach just needs to match the child’s age:

- Preschool: Start with simple saving exercises. Use jars or envelopes labelled “spend,” “save” and “share.”

- Primary School: Introduce small allowances tied to chores or responsibilities. Discuss how to plan purchases and set short-term goals.

- Teens: Teach budgeting, tracking of expenses and the use of digital tools or savings apps. Introduce them to concepts like banking, loans, interest and basic investments.

Parents can also link financial lessons to real-life experiences. Children can be involved in things like budgeting for family outings or planning back-to-school shopping.

Fun Ways to Teach Kids Financial Literacy

Learning about money doesn’t have to be serious, it can also be fun and practical. Parents and teachers can use:

- Games: Board games like Monopoly or online games.

- Chores: Earning small rewards for completed tasks teaches children the value of work.

- Mock Budgets: Have kids plan a small event, like a birthday party, within a set budget.

- Bank Visits: Let children see how accounts and savings work in real life.

Schools can also weave financial concepts into business studies or life skills classes, much like how private schools often integrate holistic programs that go beyond academics (read more about the advantages of private schools in Kenya).

Role of Schools and Parents

Both schools and parents play an essential role in shaping financially responsible children. Schools provide the foundation by integrating early financial education into the curriculum through lessons on saving, entrepreneurship and money management. Activities such as school markets, business clubs and class savings goals help students apply financial concepts in real-life scenarios.

Parents can reinforce these lessons at home. By involving children in simple budgeting, grocery planning or family saving goals, they turn abstract ideas into meaningful experiences. These moments help kids understand that money is earned, managed and valued through thoughtful choices.

When schools and families work together, children receive consistent messages about the importance of financial literacy for kids. This partnership fosters confidence, curiosity and responsibility, which are all skills that prepare young learners for a future where smart financial decisions are key to independence and success.

Challenges in Teaching Financial Literacy in Kenya

Despite its importance, teaching children about money can be challenging in Kenya. Many families face limited financial resources, while some parents lack confidence in discussing money matters. Digital access, especially in rural areas, can also restrict exposure to online financial tools.

However, progress begins with small steps. Families can start by discussing household budgets, encouraging saving (even in small amounts) and involving children in financial decision-making. Schools can complement this by offering workshops or integrating money lessons into PSHE (Personal, Social, Health and Economic) programs.

The importance of financial literacy for kids is its power to shape secure, confident and capable adults. By learning early how money works, children develop responsibility, foresight and independence. These invaluable skills will serve them throughout life.

For Kenya’s next generation, financial literacy is more than an academic subject; it’s a life skill that builds resilience in the rapidly changing world we live in. When parents, teachers and schools work together to promote youth money skills in Kenya, they’re not just preparing students for financial success, they’re empowering them to thrive in every area of life.